Best Way To Invest In Gold 2022

Best Gold Companies To Invest In

Concluding Thoughts on Gold IRAs Gold IRAs can be a smart investment, and you have options for selecting a Gold individual retirement account business - best gold etf 2022. Purchasing a Gold IRA is one of lots of ways to prepare for retirement, and if you pick to do so, you ought to understand the method to do it wisely.

These business made our top areas among all classifications: The very best Gold Individual Retirement Account Companies - best self directed ira.

Best Gold Ira Company Reviews

Consider a gold Individual retirement account. Review the 7 best gold Individual retirement account business in this guide. Few investments have been around longer than gold.

What is a Gold Individual retirement account? A gold IRA is a self-directed private retirement account whose custodian has actually chosen to offer the capability to invest in gold. Due to regulations imposed by the IRS, lots of retirement accounts, such as Individual retirement accounts, are restricted in what assets they can consist of.

Gold Ira Rollover Companies - Precious Metals Investing

But it's possible to purchase other properties as long as you can discover a custodian who supports them. So, what's the difference between investing in a gold IRA and simply buying gold directly? While gold might have some tax advantages, a gold IRA enables you to purchase gold on a tax-free or tax-deferred basis.

Gold is only permitted in IRAs that particularly determine it as a property you can buy. In the majority of typical Individual retirement accounts, gold is not enabled as an investable asset, which is the difference in between a gold IRA and other types. Which assets you can buy are determined by your IRA's custodian.

Best Gold Ira Companies In Review 2022

If you're interested in gold as a financial investment possession, one of these companies can assist you get it at a tax-advantaged rate. Goldco will help you open a precious metals IRA whether you're investing for the very first time or rolling over an existing IRA or a 401(k), 403(b), TSP, a savings account, or any other tax-advantaged retirement account.

They charge a flat annual fee for gold IRA account holders, which varies by consumer. Considering that the rate is constant, it comes out to a lower portion of your holdings the more properties you have actually purchased your account. Gold held in among their self-directed Individual retirement accounts is safely kept in a depository they manage, and you can take payments either in the kind of gold or money as soon as you reach retirement age.

Best Precious Metal To Invest In 2022

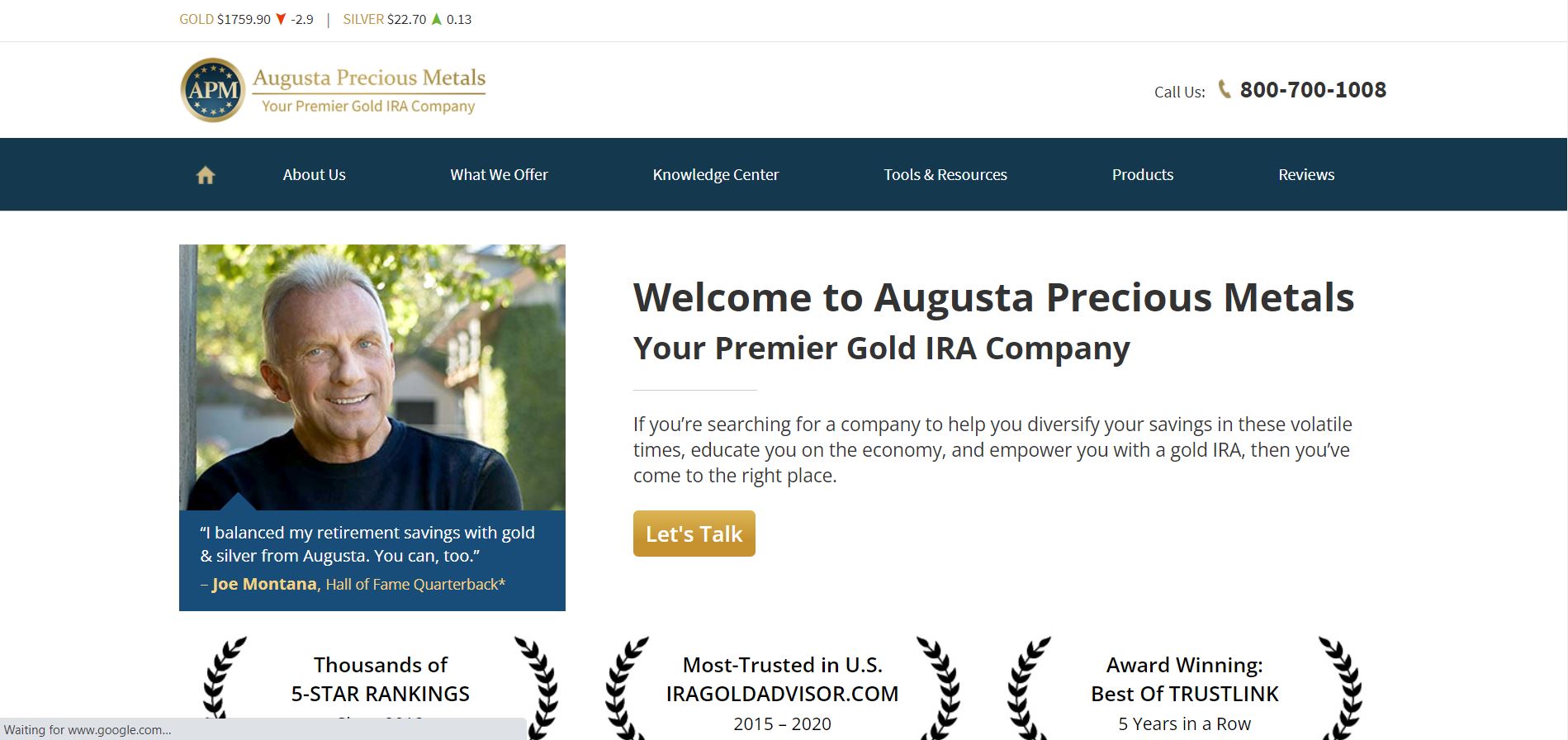

Augusta Valuable Metals: Finest Transparent Rates Founded in 2012, Augusta Precious Metals is a family-owned gold and rare-earth elements individual retirement account company. With Augusta, you can buy physical gold and silver at tax-advantaged rates. Augusta deals with numerous relied on custodians, including Equity Trust, Gold Star Trust Company, and Kingdom Trust.

You can quickly establish your gold IRA with assistance from live representatives, product preselection services to lower confusion, and a basic buying process. They'll even help you with the documents. Augusta stands apart for their transparent prices: they do not charge hidden charges, reveal their bid/ask spread, and deal continual updates to continuous transactions.

Gold Ira Companies Review 2022 - Top Rated Companies

Gold bullion, silver bullion, premium gold, premium silver Gold and Silver IRAInsured by Lloyd's of London, Roll over existing pension, Buy-back program Minimum investment: $5,000 Custodian account setup cost: $50Custodian upkeep charge: $80 per year, Depository storage charge: $100 per year, No commission costs, No management fees Finest transparent prices, No commission or management costs, Doesn't use platinum or palladium 3. gold 401K rollover.

Their team will assist you through the process of establishing a gold IRA, and as soon as it's open, they'll handle it automatically with little effort on your part. Patriot shops their gold in safe vaults across the U.S., however you can also store gold in the house in your own safe.

Best Gold Ira Companies: Top 5 Precious Metals Ira Reviews

Patriot Gold Group has a reputation for excellent consumer service, which assists them stick out from their competitors. They'll walk you through setting up your account either over the phone or online. Their prices and fees are not transparent without starting the application process. You'll need to contact them directly to select a plan.

They provide more educational products than much of their rivals and their training program is designed to guarantee you make a notified decision when opening your gold individual retirement account. When you're prepared to set up your account, the process is likewise pretty quick and easy. 4. Noble Gold: Finest Buyback Service Noble Gold was founded by Collin Plume in Pasadena, California, who has over twenty years in the rare-earth elements industry.

Best Gold Etf 2022

If you decide to open an Individual retirement account, Noble Gold has a five-minute set-up process. Noble Gold uses totally free shipping and competitive rates on gold and other valuable metals.

Any valuable metals purchased through a Noble Gold individual retirement account are held in safe storage they offer. Qualified accounts consist of 401(k)s, 403(b)s, 457(b)s, TSPs, Roth, SEP or SIMPLE IRAs, and particular pensions. Gold, silver, platinum, palladium Gold, silver, platinum and palladium IRARoll over existing retirement accounts, Outstanding client service Annual Charges: $80Storage Cost: $150 (if you keep your possessions in Texas or Delaware)Custodian Charge: Varies by customer Excellent buy-back service, No aggressive salespeople, Affordable fees, Yearly charges high for low balances 5.

Precious Metals - Gold Ira - Silver Ira

- Buy physical gold bullion in the form of bars or coins.

- Buy gold mutual funds or exchange-traded funds (ETFs).

- Trade gold options or futures contracts.

- Purchase gold certificates backed by a government mint.

- Acquire solid gold jewelry as an investment.

Is it right time to buy gold 2022?

The yellow metal is expected to give higher return in 2022 owing to geopolitical tensions along with rising inflationary concerns supporting precious metal prices on lower levels.

How can I buy 24k gold?

Pure gold in 24 carat can be obtained online via various banks. Banks like ICICI, HDFC, Axis Bank etc. offer customers an option to procure gold online. Customers just need to login to their online banking accounts, place the order for buying gold and then visit the nearest bank branch to receive their gold coin.

Who controls gold price?

The Indian Bullion Jewellers Association or the IBJA as it is known plays a key role in determining day to day gold rates in the country. IBJA members include the biggest gold dealers in the country, who have a collective hand in establishing prices

Which country is best for buying gold?

So, for the love of gold and shopping, check out the 5 best places in the Visit Website world to buy gold.

Dubai, UAE. When look at this web-site you think of see it here Dubai, the idea of buying browse this site gold surely pops up immediately.

Bangkok, Thailand.

Hong Kong, China.

Cochin, India.

Zurich, Switzerland.

Regal Assets supports investing in silver, platinum, and palladium. By providing a mix of hard assets and digital possessions, they believe they can supply security versus inflation and volatility, as well as profit - best gold etf 2022.

Regal Assets doesn't charge any extra costs for rollover or transfer services. gold investment.

Etfs Physical Gold

Benefit Gold: Best for Beginners One of the newer arrivals on the gold IRA scene, Benefit Gold was established in 2014, but they have a solid performance history and positive client evaluations. It's easy to set up an IRA with Advantage; simply apply, your application will be evaluated by one of their investment professionals, and you can money your account or rollover an existing pension.